Capitalizing Child Care:

The National Landscape of Grants, Loans, and Community Development Capital in Early Childhood Education

About the Project

Researchers have studied the costs of providing high quality child care, yet less attention has been paid to the role that access to capital plays in supporting child care programs. The National Children’s Facilities Network (NCFN) and NCFN Executive Committee Member Reinvestment Fund have undertaken a project to identify and map the financial institutions and intermediaries that help finance the child care industry — including the child care business operations and physical facility spaces.

The project aims to shed a light on the community ecosystem that is necessary to support a thriving child care sector. The report and accompanying mapping tool describe the activity of foundations, community finance organizations, and SBA lenders in the child care sector. Stakeholders and community leaders can use the mapping tool to identify the sources of capital supporting child care businesses in their community.

Key Findings

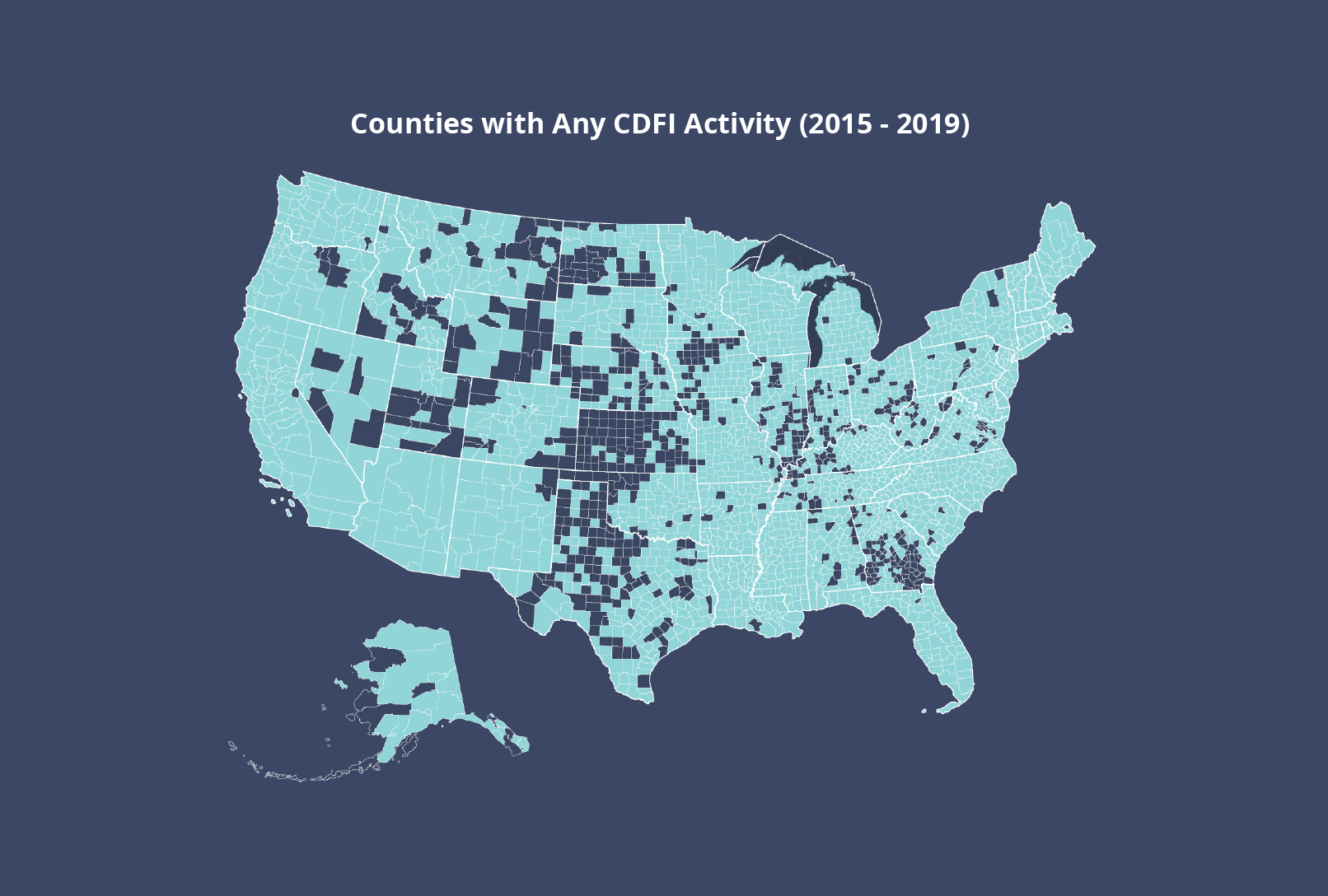

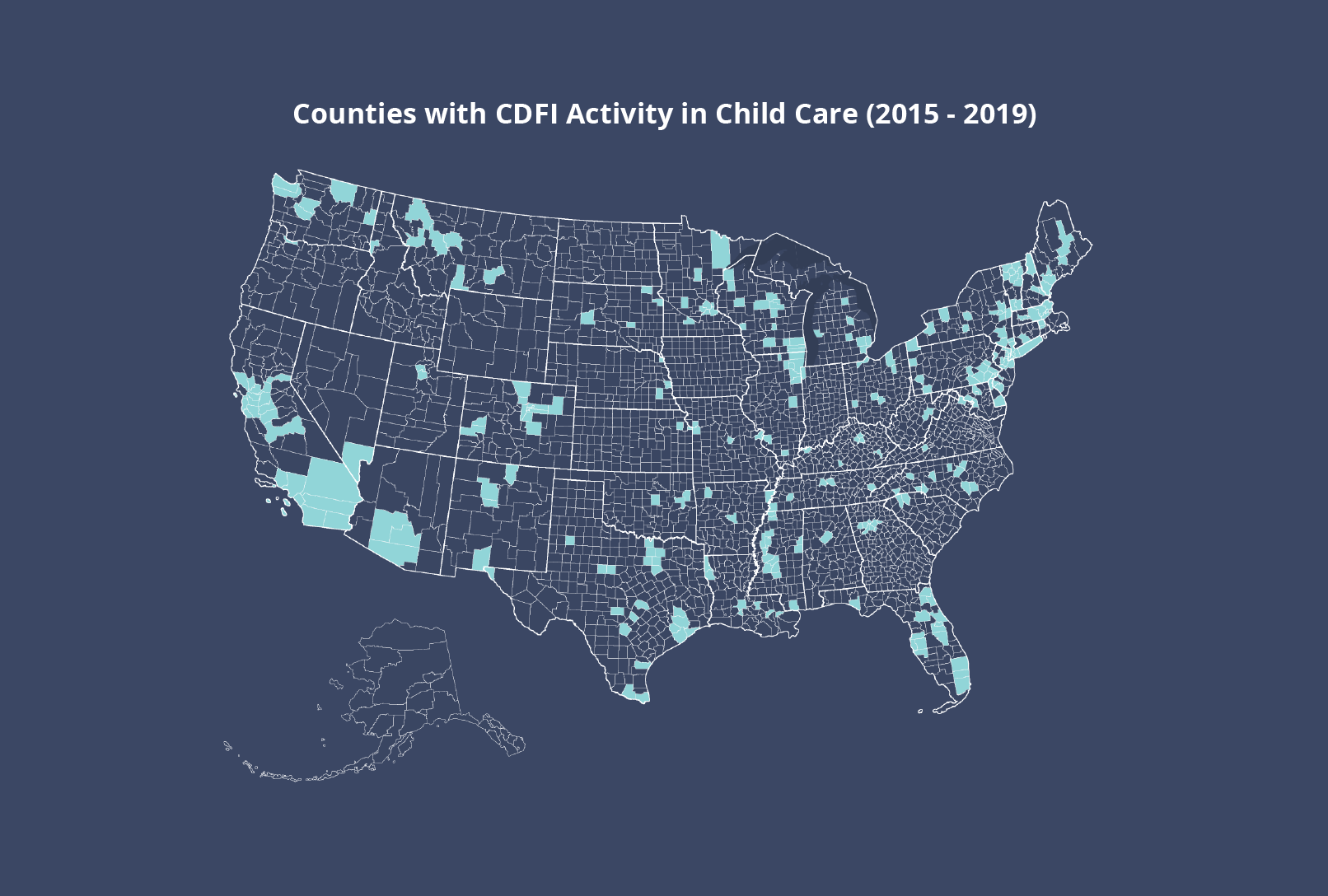

As community facilities that support the social, emotional, and educational development of children, as well as small businesses often led by historically disadvantaged entrepreneurs, child care providers are a strong fit for the mission and focus of many CDFIs. Unlike SBA lenders, CDFIs are not restricted by a child care program’s for-profit or nonprofit status.

Different types of organizations are critical for serving the diverse range of child care providers that exist in every community. Communities with the strongest child care sectors are those where stakeholders from the child care, philanthropic, banking, and community finance sectors work together to identify and fill gaps in the availability of resources that child care businesses need.

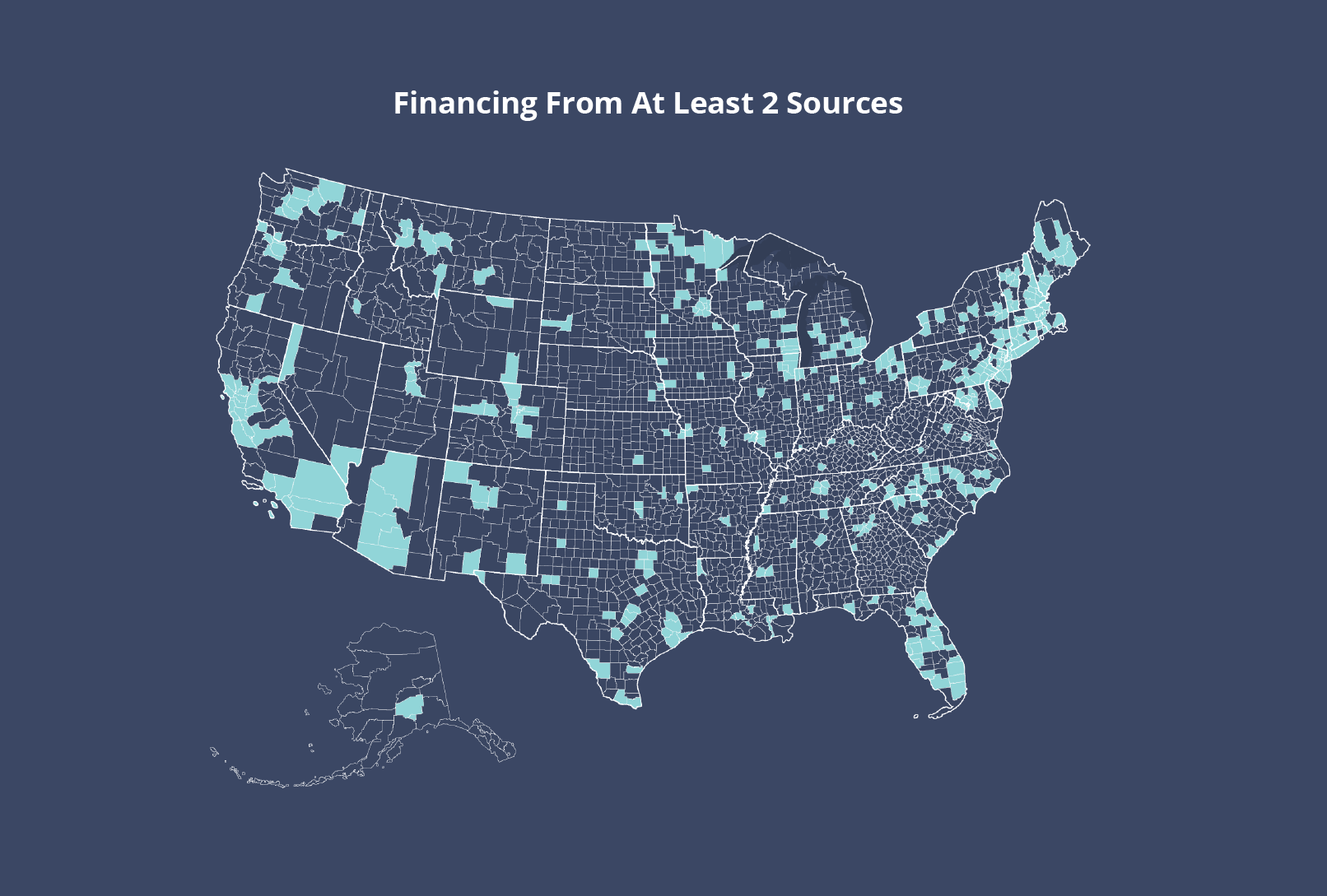

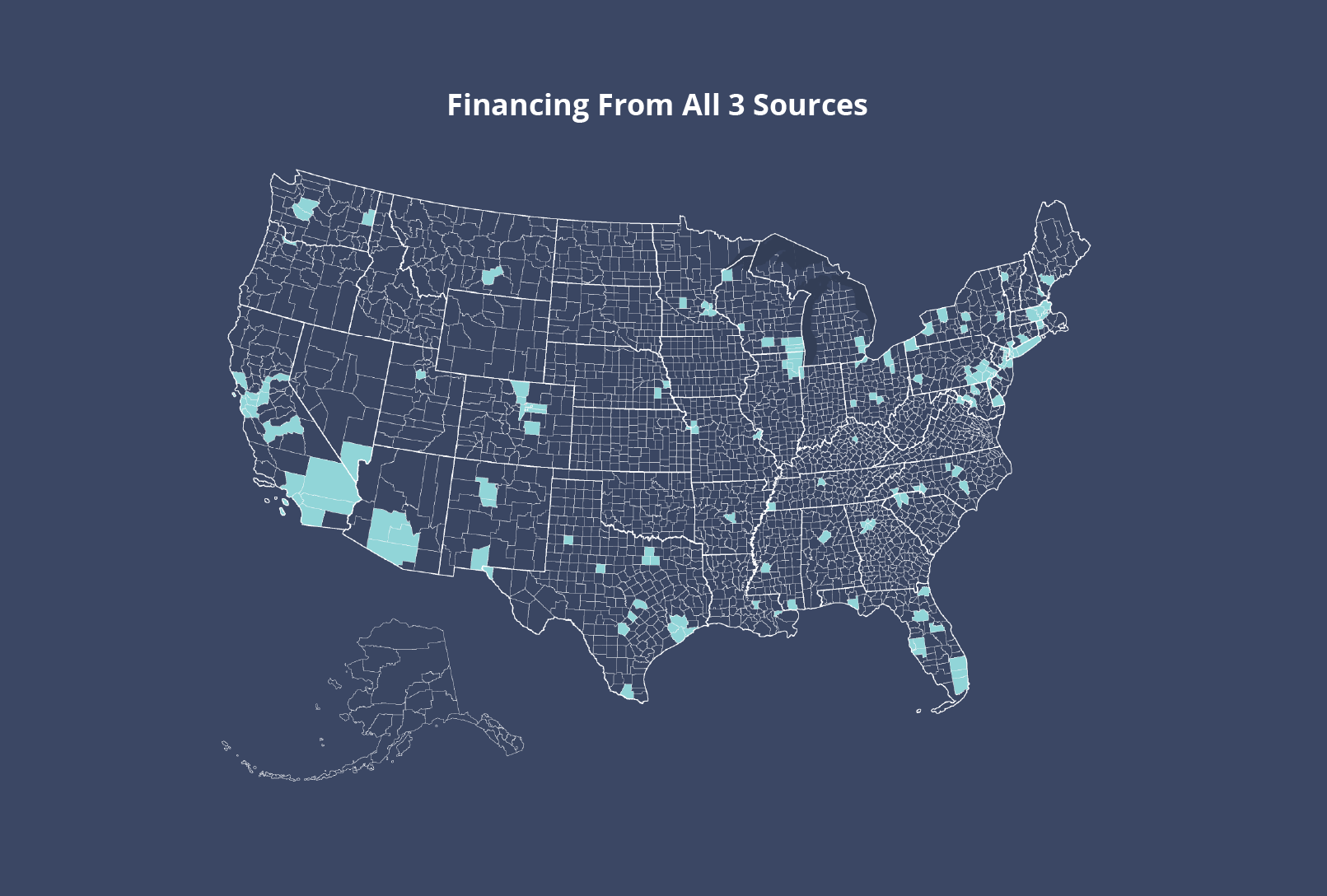

Many rural areas lack financial intermediaries that are critical for supporting child care financing. Only 166 of the 3,142 counties in the U.S. have SBA lending, CDFI lending, and philanthropic activity working to financially support child care businesses.

Scroll to view geographic access to child care capital

Scroll to view geographic access to child care capital

Scroll to view geographic access to child care capital

Scroll to view geographic access to child care capital

Scroll to view geographic access to child care capital

Scroll to view geographic access to child care capital

Scroll to view geographic access to child care capital

Scroll to view geographic access to child care capital

Scroll to view geographic access to child care capital

Future Directions for Research & Advocacy

This project is part of NCFN’s ongoing commitment to support financial and technical assistance intermediaries dedicated to helping ECE providers develop high-quality physical learning environments and sustainable business models.

Continue to advocate for greater resources in the sector. One of the largest challenges in financing child care providers is the lack of adequate funding in the sector. Greater resourcing can help providers better attract the capital they need to grow their businesses.

Further develop our understanding of resources and capital in the child care sector. This report examined three sources of capital – foundations, community development organizations, and SBA lending – but future research should explore the role of traditional business lenders as well as states and counties working to support child care expansion.

Develop targeted assistance and outreach to encourage greater CDFI participation in child care. CDFIs play a critical role in the financial ecosystem that supports child care businesses. Yet too few communities have access to CDFIs that are engaged with the child care sector.

Understand more about the conditions under which SBA lenders support child care. The SBA is a critical resource for small businesses, yet too often child care businesses, particularly small providers, struggle to connect with SBA programs.